The reconciliation statement allows the accountant to catch these errors each month. The company can now take steps to rectify the mistakes and balance its statements. Financial statements show the health of a company or entity for a specific period or point in time. The statements give companies clear pictures of their cash flows, which can help with organizational planning and making critical business decisions.

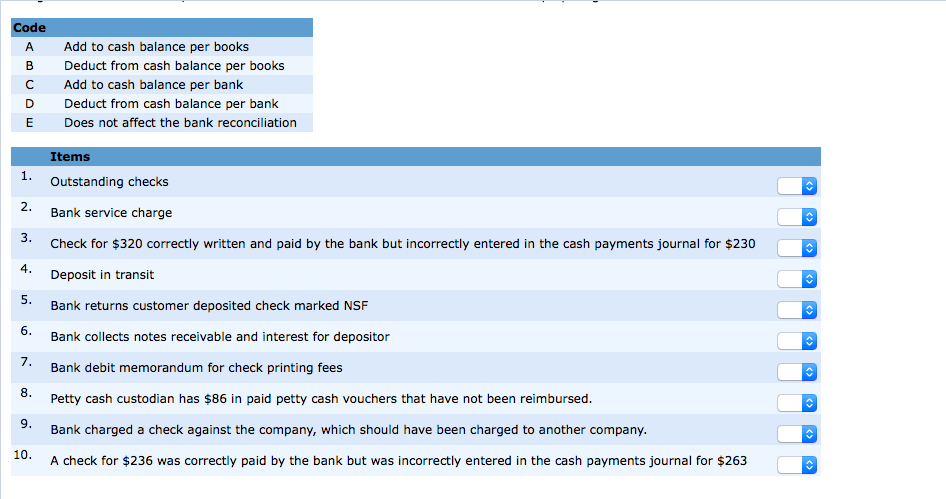

Depending on how you choose to receive notifications from your bank, you may receive email or text alerts for successful deposits into your account. Next, check to see if all of the deposits listed in your records are present on your bank statement. For instance, the bank charged your business $30 in service fees, but it also paid you $5 in interest. These items are typically service fees, overdraft fees, and interest income. You’ll need to account for these fees in your G/L in order to complete the reconciliation process. When you’re completing a bank reconciliation, the biggest difference between the bank balance and the G/L balance is outstanding checks.

Data entry error

Nowadays, all deposits and withdrawals undertaken by a customer are recorded by both the bank and the customer. The bank records all transactions in a bank statement, also known as passbook, while the customer records all their bank transactions in a cash book. A bank reconciliation should be prepared periodically to ensure accurate financial records. This practice is essential for maintaining the financial health and integrity of your business.

- At times, you might give standing instructions to your bank to make payments regularly on specific days to third parties, such as insurance premiums, telephone bills, rent, sales taxes, etc.

- Check out Sheetgo for Finance and experience the benefits of automated bank reconciliation firsthand.

- Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank.

- Go through both statements and highlight any transactions that appear on only one side.

Why Is It Important To Reconcile Your Bank Statements?

If you’re interested in automating the bank reconciliation process, be sure to check out some accounting software options. As a result, you’ll need to deduct the amount of these checks from the balance. When your business receives checks from its customers, these amounts are recorded immediately on the debit side of the cash book so the balance as per the cash book increases.

Such errors are committed while recording the transactions in the cash book, so the balance as per the cash book will premium vs discount bonds differ from the passbook. At times, the balance as per the cash book and passbook may differ due to an error committed by either the bank or an error in the cash book of your company. There are times when your business will deposit a check or draw a bill of exchange discounted with the bank.

Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank. Unpredictable interest income may also be a challenge when calculating financial statements, which can lead to challenges during a bank reconciliation. An NSF (not sufficient funds) check is a check that has not been honored adjusting entries by the bank due to insufficient funds in the entity’s bank accounts.

Make Necessary Adjustments in the Balance as per the Cash Book

Compare your personal transaction records to your most recent bank statement. First, make sure that all of the deposits listed on your bank statement are recorded in your personal record. If not, add the missing deposits to your records and your total account balance. The goal of bank account reconciliation is to ensure your records align with the bank’s records. This is accomplished by scanning the two sets of records and looking for discrepancies.

If the charges are not from your bank, the bank can also help you identify the source so that you can prevent any fraud or theft risk. Greg’s January financial statement for the company shows $100,000 in cash, but the bank statement shows only $88,000. Let’s take a look at a hypothetical company’s bank and financial statements to see how to conduct a bank reconciliation. Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. It’s recommended for a company to perform a bank reconciliation at least once a month.

Step 2: Work Out the Balance as Per Bank Side of the Bank Reconciliation Statement

You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows). Bank reconciliation is a crucial financial process for businesses to ensure that records match bank statements. Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available. Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records. Bank reconciliation statements compare transactions from financial how to become an ea tax preparer records with those on a bank statement. Where there are discrepancies, companies can identify and correct the source of errors.

This means that the check amount has not been deposited in your bank account and hence needs to be deducted from your cash account records. By comparing your company’s internal accounting records to your bank statement balance, you can confirm that your records are accurate and analyze the reasons behind any potential discrepancies. The purpose of reconciling bank statements with your business’ cash book is to ensure that the balance as per the passbook matches the balance as per the cash book. There are bank-only transactions that your company’s accounting records most likely don’t account for.